Structure Overview

The key elements of the structure for representing a long-term model in Predictor are as follows:

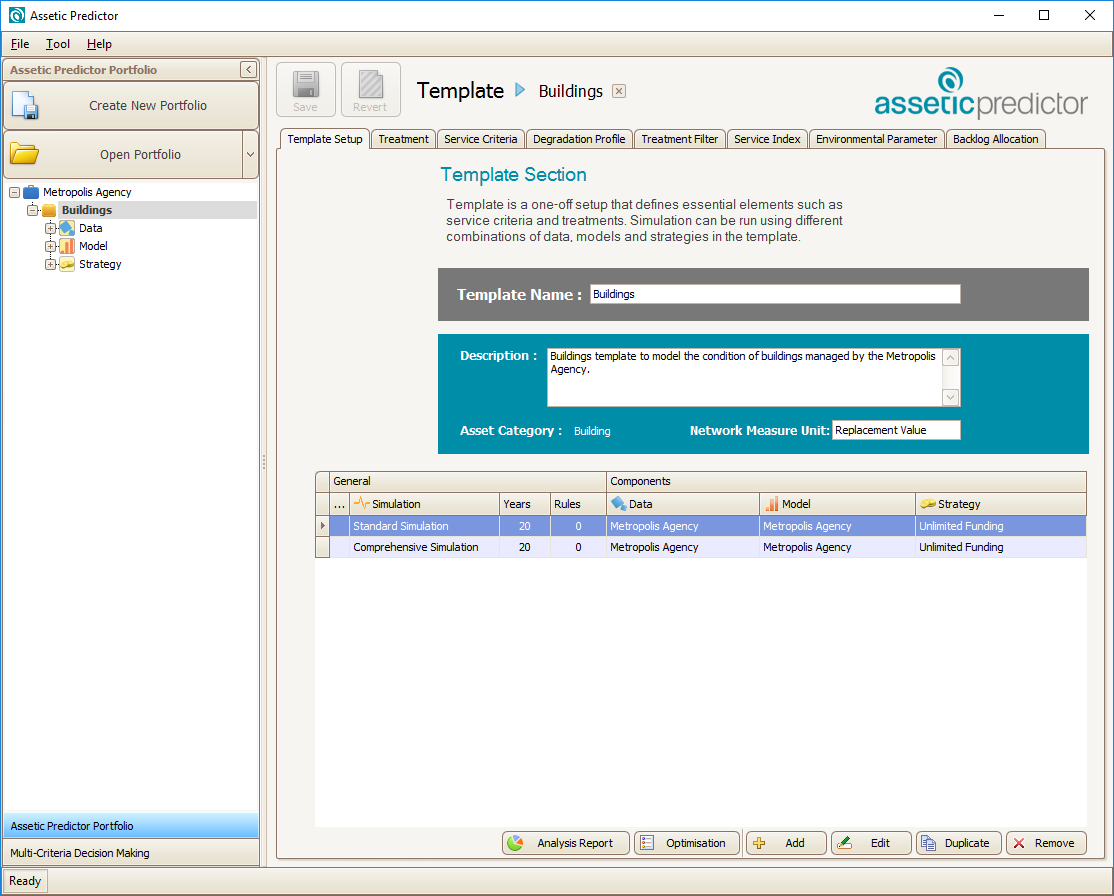

1. Portfolio - A portfolio is a collection of assets or asset categories (e.g. buildings and roads). The portfolio aggregation facility in Predictor allows organizations to provide whole of agency financial analysis by combining simulation results carried out under different templates.

2. Templates - A template corresponds to each asset category in that portfolio. Each template consists of the following elements:

- Data - Asset repository

- Model - Simulation of engineering performances

- Strategy - Simulation of financial performances

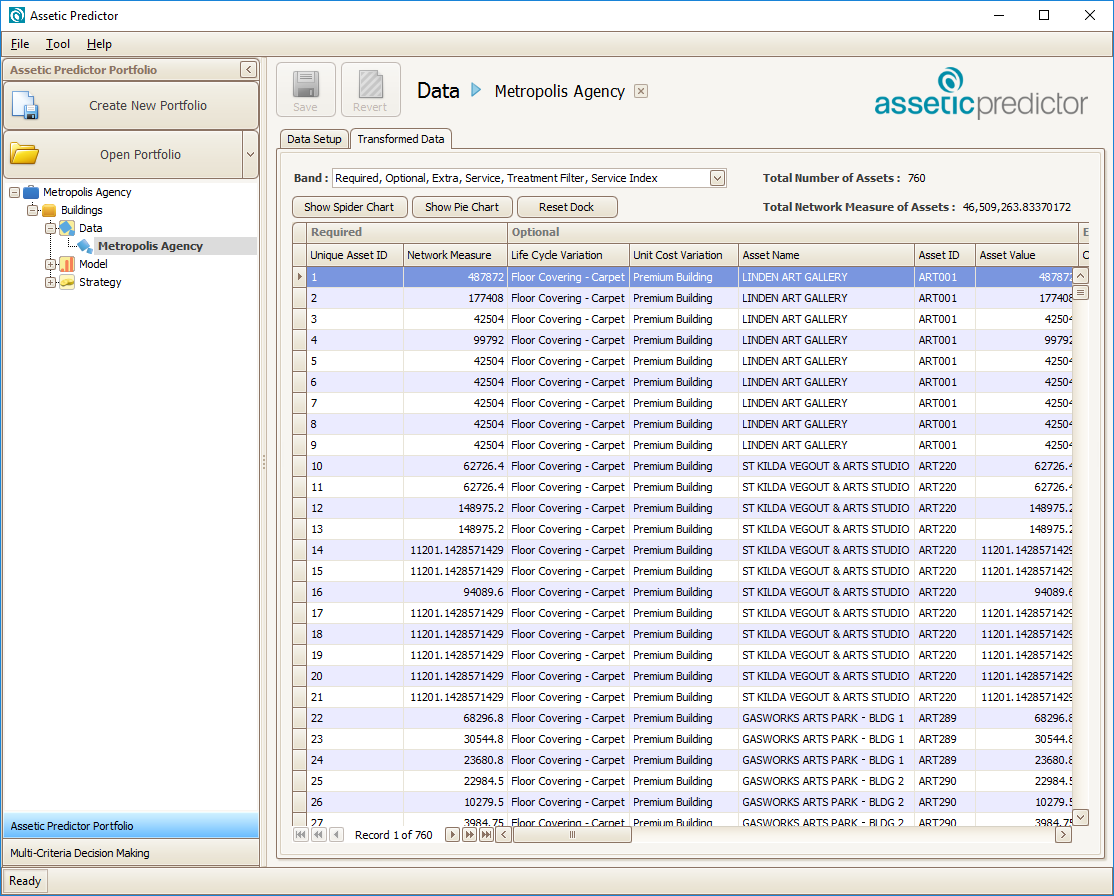

3. Data - Predictor allows multiple data sets for each asset category.

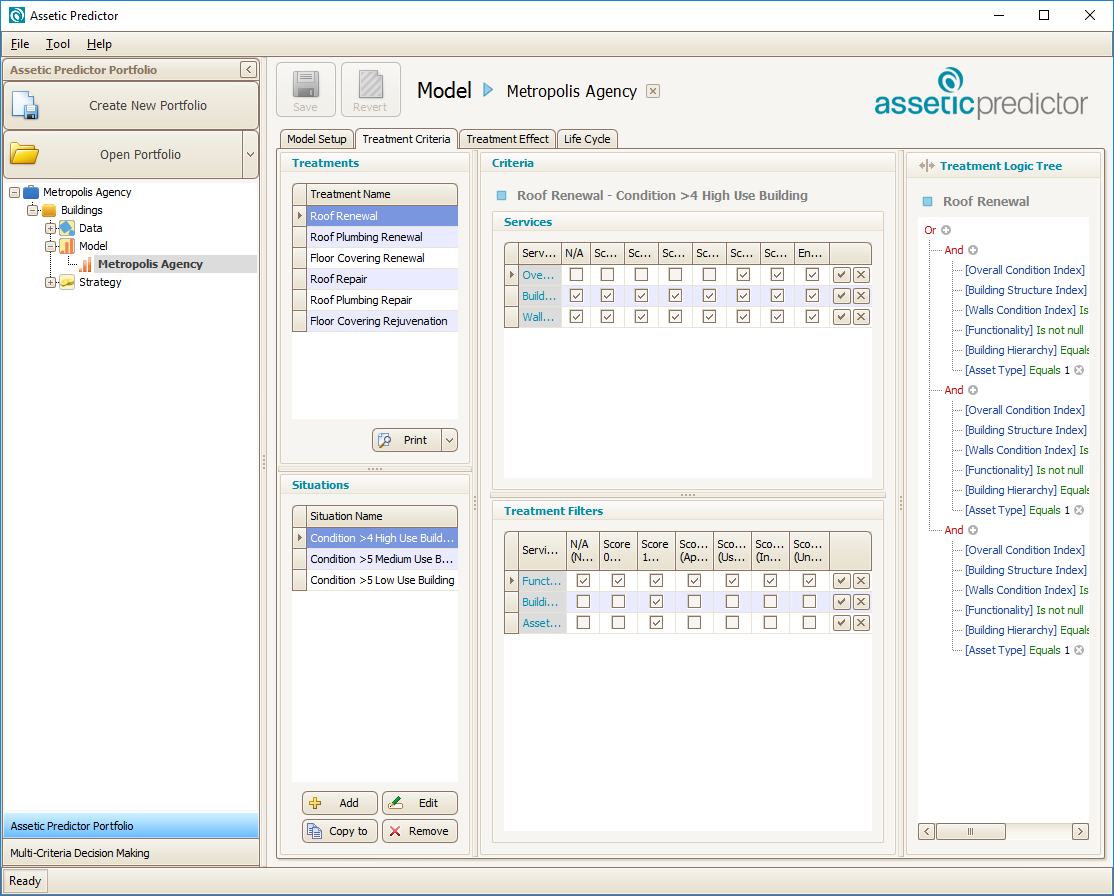

4. Models - Predictor allows multiple engineering and carbon accounting models for each asset category.

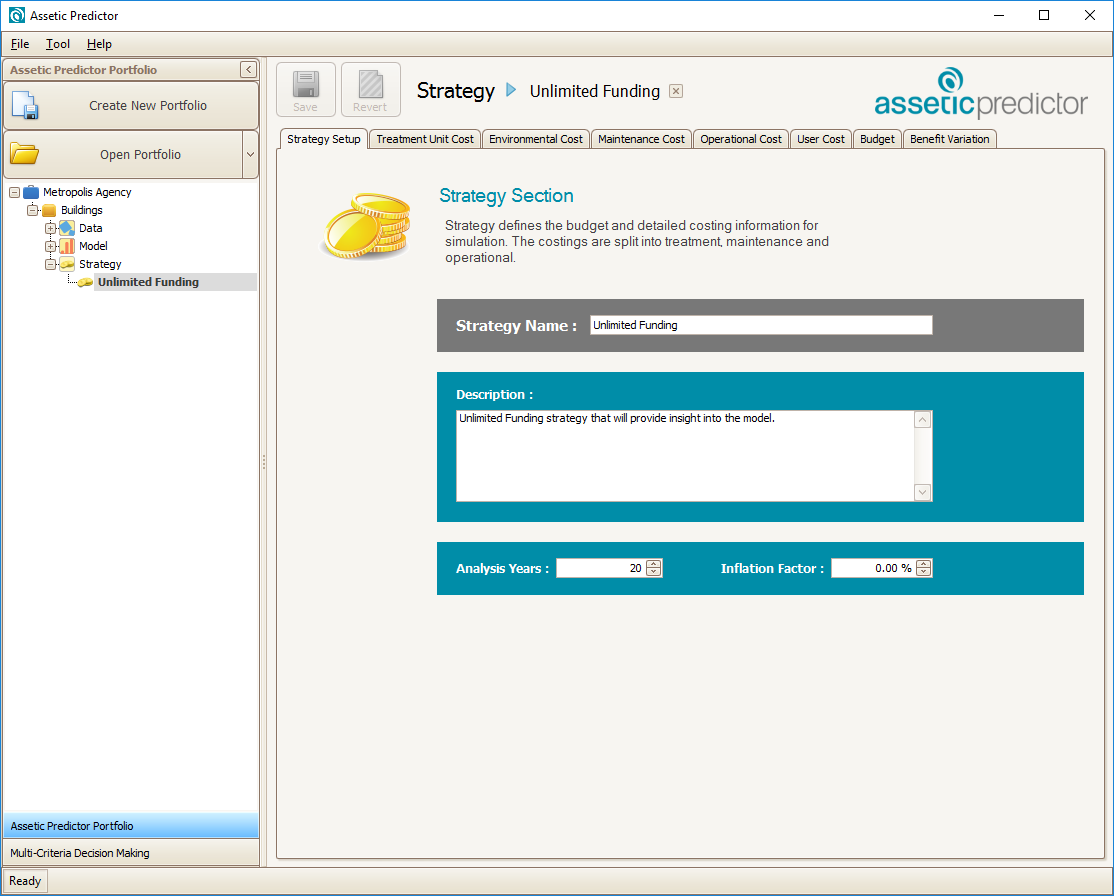

5. Strategies - Predictor allows multiple financial strategies for each asset category.

6. Simulations - Simulations are a combination of user-defined data, models, and strategies. Predictor allows multiple simulations using different combinations.

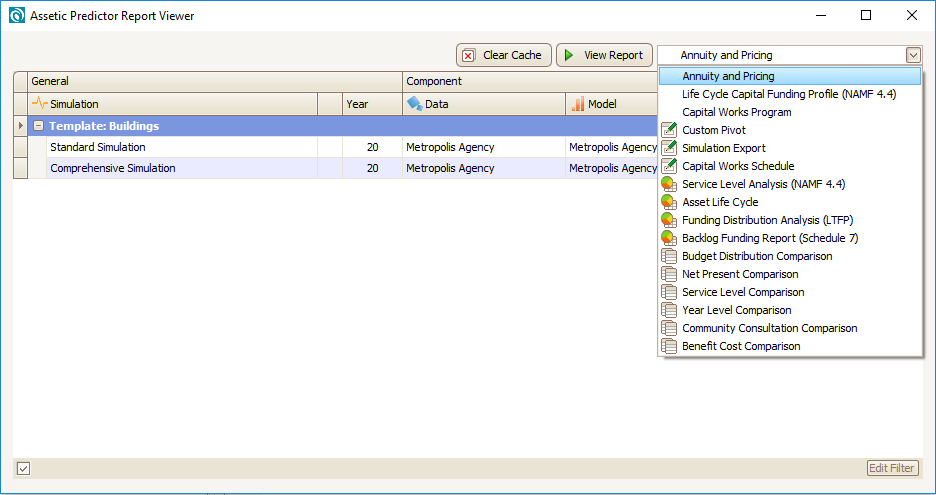

7. Reports - Predictor includes a range of reports that provide direct input into asset management plans in line with the national asset management framework and state based guidelines.

8. Whole of Agency Funding - Predictor produces the whole of organization scenarios by aggregating various asset classes.